colorado estate tax exemption 2021

No estate tax or inheritance tax connecticut. Teller County CO December 30 2021 A new Colorado state law sponsored as House Bill 21-1312 concerning insurance premium property sales severance tax was signed by Governor Polis into law on June 23 2021.

Colorado Estate Tax Everything You Need To Know Smartasset

Provides an exemption from property taxes.

. Fax or deliver in person this form to the Colorado Division of. The three basic requirements are. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021.

That means that if the right legal steps are taken a married couple can protect up to 2412 million when both spouses die. Late reports filed after the April 15 deadline must be accompanied by the 250 late filing fee. However the federal unified credit reduces the federal estate tax liability and therefore can affect the state tax liability.

The deadline to file a 2022 Exempt Property Report is April 15 2022. The number of seniors claiming the exemption has grown over time from 123326 qualifying. The following documents must be submitted with your application or it will be returned.

Whose tax payments may increase. Previously qualified for the exemption also qualifies. Dian Feral has lived in her Westwood neighborhood home in Denver for about 30 years.

When you file through the Revenue Online service you will be prompted to provide the deductions information and it will become part of the e-filed return. The estate tax exclusion is 4000000 as of 2021 after the district chose to lower it from 5762400 in 2020. Under the new law commencing Jan 1st 2022 business personal property exemption will change from 7900 to 50000.

175 for Applications for Exemption 75 for timely filed Exempt Property Reports 250 for Exempt Property Reports filed after the initial April 15 deadline. Colorado Senior Property Tax Exemption A property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously qualified. Living on a fixed income she has come to depend on her senior property tax exemption to help pay for items like vet bills for one of her favorite cats.

Only organizations exempt under 501 c. Sep 28 2021 Legislative Resources. Identification of Applicant and Property.

Religious groups may continue to file late 2022 reports until July 1 2023. Applicants Name First Middle Initial and Last Social Security Number. 405 AM MDT on Jun 4 2021.

Chris Stiffler CFI senior economist and author of Inequities in Colorado. The number of seniors claiming the exemption has grown over time from 123326 qualifying seniors in tax year 2002 to 262130 seniors in tax year 2020. The property tax exemption is 500 percent of the first 200000 of actual property value for qualifying homeowners.

Classification and Valuation of Agricultural Property in Colorado 2022 Property Tax Exemption for Disabled Veterans in Colorado 2022 Manufactured Homes In Colorado 2022 Rebates. Complete the Application for Sales Tax Exemption for Colorado Organizations DR 0715. History of Senior Property Tax Exemption 2021.

The senior homestead property tax exemption became available beginning in property tax year 2002 following voter approval of Referendum A in the 2000 General Election. Pursuant to 39-3-1195 the personal property minimum filing exemption threshold exemption amount for tax years 2021 and 2022 is 50000 or less in total actual value. The 2022 filing period ends July 1 2022 for schools charitable organizations and fraternalveteran groups.

Timely filings with a 75 filing fee per report are due by April 15. The Colorado estate tax is calculated as the share of the estate that includes Colorado property multiplied by the state death tax credit. Effective January 1 2022 business.

There are two main types of bankruptcy for individuals. A property-tax exemption is available to senior citizens surviving spouses of senior citizens and one hundred percent disabled veterans For those who qualify 50 percent of the first 200000 in the actual value of their primary residence is exempted from property taxation The state pays the exempted portion of the property tax The Property Tax Exemption for seniors and one. Attach a copy of your Federal Determination Letter from the IRS showing under which classification code you are exempt.

Applies to one primary residence. Nor my spouse is receiving the senior citizen or the disabled veterans property tax exemption on any other property in Colorado. If an estate tax.

If the return is filed on paper the total from the Deductions schedule must be reported on the sales tax return and the Deductions schedule must also be submitted with the sales tax return. The colorado homestead exemption allows one to exempt up to 75000 of their real property value when filing. Even though there is no estate tax in Colorado you may still owe the federal estate tax.

The unified credit applies to both federal gift tax and estate taxes. 1 2021 and Jan. No state exemptions are allowed.

Chapter 7 bankruptcy is typically applied to lower income. To qualify for the property tax exemption as a disabled veteran the individual must be honorably discharged and have service-connected disability rating of 100 percent. In the November 2000 election Colorado voters passed a Property Tax Exemption for seniors known as Referendum A.

The Colorado Homestead Exemption allows one to exempt up to 75000 of their real property value when filing bankruptcy. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. The exemption is adjusted for inflation thereafter.

The senior homestead property tax exemption became available beginning in property tax year 2002 following voter approval of Referendum A in the 2000 General Election. This tax is portable for married couples. The state is required to reimburse local governments for the lost revenue as a result of the increased exemption.

Those who miss the deadline and forfeit tax exemption will receive notifications by mail. Ad From Fisher Investments 40 years managing money and helping thousands of families. 1 the qualifying senior must be at least 65 years old on January 1 of the year in which he or she qualifies.

Monday - Friday 730 am. One of the new laws HB-1311 will eliminate certain state tax deductions for individuals and households with higher. In 2022 Connecticut estate taxes will range from 116 to 12 with a 91-million.

The exemption for that tax is 1170 million for deaths in 2021 and 1206 million in 2022. The Act increases the exemption for business personal property tax from 7700 to 50000 for tax years beginning Jan. Do you make more than 400000 per year.

Qualifying seniors will see 50 percent of the first 200000 of actual value of their primary residence exempted from property tax.

Back To Business Nebraska Chamber Of Commerce Industry

Jackson County Assessor Jackson County Colorado

2021 Quick Tax Guide Obermeyer Wood Investment Council

2021 Taxes And New Tax Laws H R Block

:strip_icc()/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

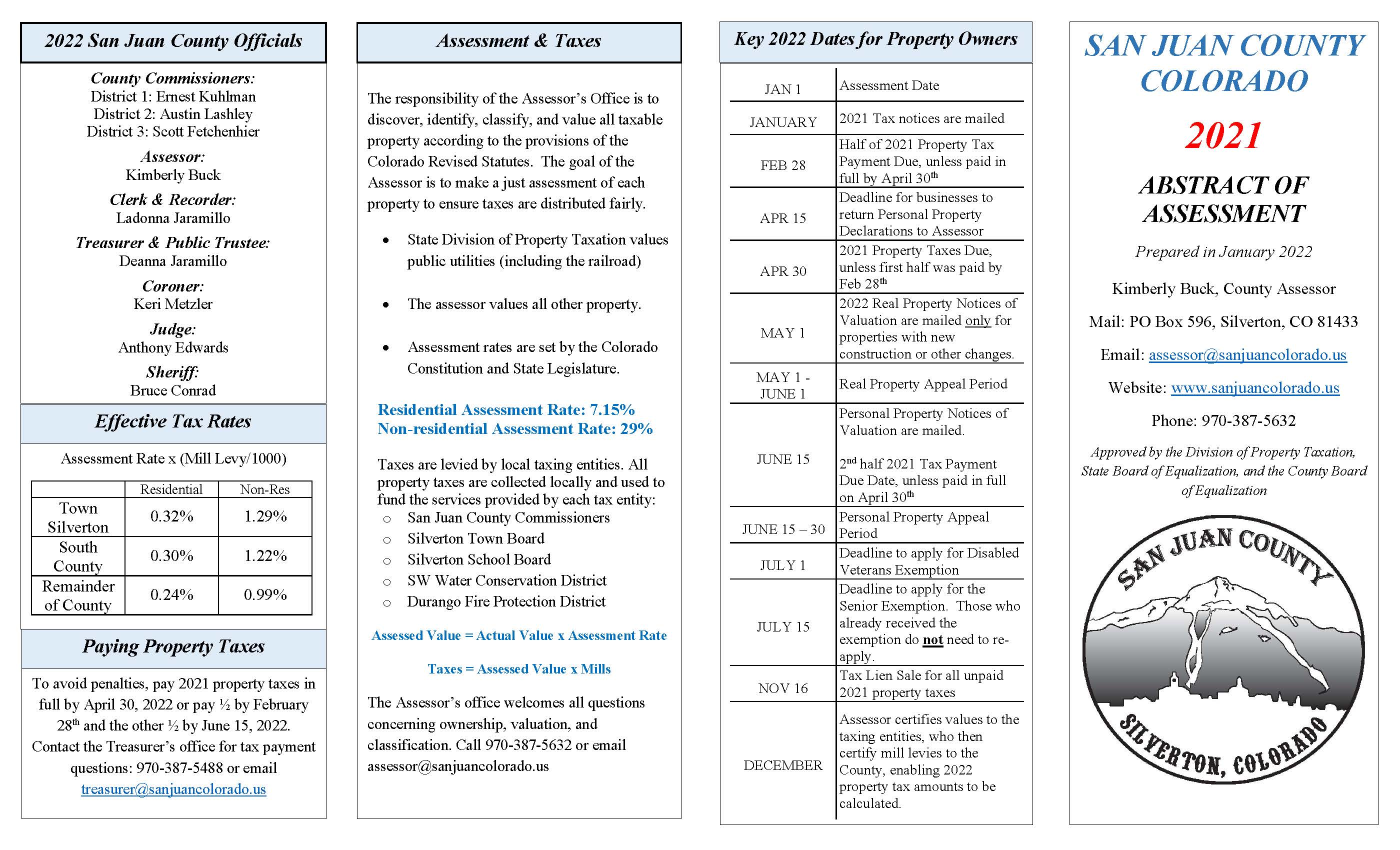

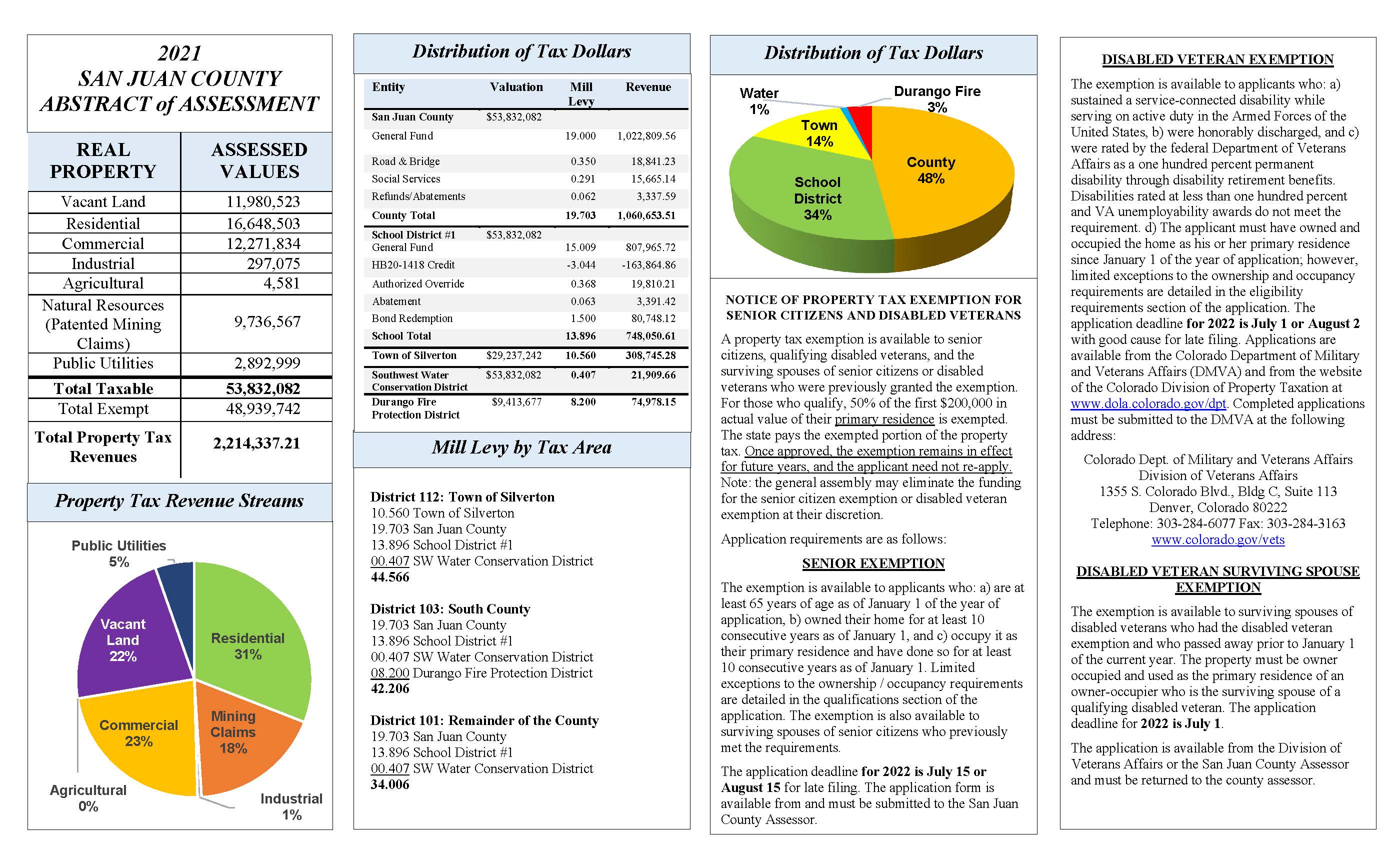

Calculating Property Taxes San Juan County

Colorado Estate Tax Do I Need To Worry Brestel Bucar

How To Plan Around Estate Tax Uncertainties Charles Schwab In 2021 Estate Tax Capital Gains Tax Tax

3 11 3 Individual Income Tax Returns Internal Revenue Service

It S Tax Season Will My Alimony Be Tax Deductible In 2021

Can You Avoid Capital Gains Taxes When Selling A Second Home Upnest

Calculating Property Taxes San Juan County

State Corporate Income Tax Rates And Brackets Tax Foundation

Colorado Estate Tax Everything You Need To Know Smartasset

Colorado Estate Tax Do I Need To Worry Brestel Bucar

2021 Quick Tax Guide Obermeyer Wood Investment Council

Colorado Estate Tax Everything You Need To Know Smartasset

Pin By Sandrape Vector Tracing On Freelance Website Designer Near Me In 2021 Freelancer Website Website Design Start Up